Signed in as:

filler@godaddy.com

Signed in as:

filler@godaddy.com

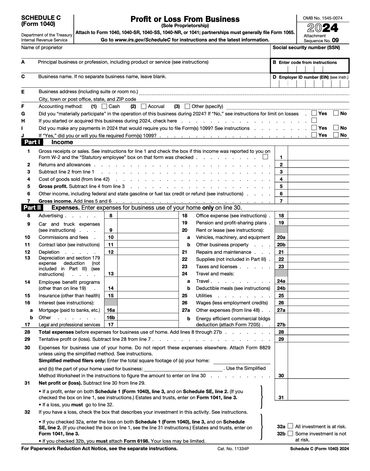

For freelancers, gig workers, and entrepreneurs, the schedule c tax form is one of the most important documents to file each year. It is the primary way that self-employed individuals in the United States report income and expenses from their business activities to the Internal Revenue Service (IRS). Whether you run a small consulting practice, drive for ride-sharing platforms, or own a local shop, understanding how to prepare and use Schedule C is essential to stay compliant and optimize your tax situation.

The irs schedule c (officially known as “Profit or Loss From Business”) is designed to show whether your business made a profit or incurred a loss during the tax year. It applies to sole proprietors and single-member LLCs who must report their income as part of their personal tax return (Form 1040).

The irs schedule c includes sections for:

Filing this form accurately is not just about compliance. It helps small business owners demonstrate legitimate deductions, reduce taxable income, and provide a clear record for lenders or investors.

Not everyone running a business needs to incorporate or create complex accounting reports. The schedule c irs form is required for anyone who earns income independently and does not operate as a corporation. Common examples include:

The schedule c irs is straightforward but still demands accuracy. Reporting too little income or forgetting deductible expenses can cause tax issues. On the other hand, properly documenting costs ensures lower taxable income and greater financial clarity.

While often viewed as just another tax form, the schedule c is a powerful tool for tracking financial performance. By listing income and categorizing expenses, you can evaluate whether your business is sustainable. It essentially acts as a mini profit-and-loss statement built directly into your tax filing.

A critical part of the form is schedule c business expenses. These deductions can cover a wide range of categories:

Claiming legitimate schedule c business expenses reduces your taxable income, which lowers your overall tax liability. The key is keeping receipts and accurate records throughout the year. Many self-employed workers also rely on accounting software to simplify the process.

For many entrepreneurs, the business schedule c is the most practical method of reporting. Unlike corporate filings, it is integrated into a personal tax return, avoiding double taxation and reducing administrative burden.

The business schedule c gives you flexibility. You can track your revenue, list your expenses, and even claim losses that may offset other income on your return. This feature is particularly useful in the first years of running a business, when start-up costs are often higher than income.

At the same time, submitting a business schedule c accurately builds credibility. Lenders and investors who review your tax history often use these forms to assess your financial responsibility. A consistent record of properly filed returns increases trust and opens doors to credit or growth opportunities.

Another important aspect of the schedule c is the ability to separate personal and business finances. Many self-employed individuals initially mix their earnings with everyday expenses, which creates confusion and raises red flags during audits. By using the irs schedule c consistently, you establish a clear financial boundary. This not only helps in maximizing schedule c business expenses but also makes it easier to prove your income when applying for a mortgage, business loan, or insurance coverage. In practice, accurate categorization builds both tax efficiency and professional credibility.

The schedule c is much more than a bureaucratic requirement. It is a vital financial document that shows your revenue, expenses, and profitability in a clear format. By using the irs schedule c or schedule c irs, freelancers and small business owners can comply with tax law while also gaining insights into their business performance.

A well-prepared schedule c highlights deductible costs, ensures you take advantage of legitimate schedule c business expenses, and positions your enterprise for sustainable growth. For entrepreneurs, a properly filed business schedule c is not only about paying taxes correctly—it is also a tool for managing finances, attracting partners, and planning the future.

Copyright © 2025 DZAR - All Rights Reserved.

We use cookies to analyze website traffic and optimize your website experience. By accepting our use of cookies, your data will be aggregated with all other user data.